Imagine having a singular hub for all your insurance needs. Meet Marble, an Avanta Ventures Studios company dedicated to helping customers oversee their insurance. Their mission is to ensure members control one of the most important financial instruments in their lives: their insurance.

We recently spoke with Stuart Winchester, Founder & CEO of Marble, to learn more about the company and how they assist people with organizing and controlling every aspect of their insurance policies via a singular digital wallet.

How do you impact your customers’ lives?

Marble aims to solve two big problems in insurance. The first is that 43% of Americans store their insurance info in PDF or paper printouts, which can be unreliable or risky. I’m referring to a trillion-dollar household asset class, and we expect most Americans to grapple with it using very outdated technology or none at all.

The other big issue is that insurance is an enormous household expense and, as an industry with falling retention, lacks a current rewards program.

We address both by giving our members unparalleled control of their insurance and the things they want to protect while also making our rewards technology available to industry-leading carriers and brokers.

Tell us more about Marble. What are the benefits of your digital wallet?

Marble’s founding team and board of advisors have deep knowledge spanning insurance, loyalty, and technology. A group of leading investors supports us with decades (and decades) of insurance and technology experience. With their expert support, we’re building a unique platform that blends the innovation and speed of a startup with the knowledge and fortitude of an industry veteran.

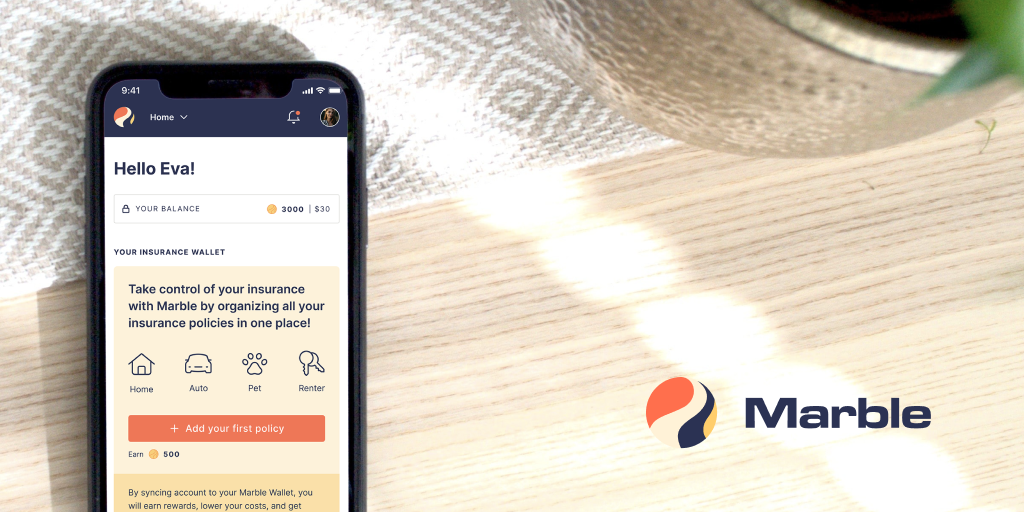

Our team is committed to helping customers stay on top of their insurance by organizing all their policies in one place. We look out for their best interests by alerting them when policies are close to expiration, then providing unbiased information to compare rates and find the best policy for them. Working hand-in-hand with carriers, Marble has built the first rewards-based membership program in the world of insurance.

Our team is committed to helping customers stay on top of their insurance by organizing all their policies in one place.

Which industries do you target?

We have already put our members in control of their auto, home, pet, and renters insurance, with life and health insurance coming later in the year. Additionally, we are working with an auto insurer with a million-plus policies to build a bespoke rewards program.

Which current technology trends in the insurance industry and the world at large have an impact on your business?

As finance has moved online (both personal and business), we’ve seen neo-banks gobble up market share by the percentage point by offering a product and technology suite that is user-first versus fee-first. From paycheck advancing to no-fee trading, customers who move to fintech companies are enjoying the benefits of modern modular technology. The state of play of innovation in fintech should (and I believe will) motivate insurance companies.

The state of play of innovation in fintech should (and I believe will) motivate insurance companies.

What’s the market size for this opportunity?

The market size for the first rewards program for home, car, and other personal insurance products is about a trillion dollars-plus in insurance premiums in just the US market alone. Layering payments, risk mitigation technology, and financing in addition to that give us a very compelling market width and depth. We’re the first to market with solutions that holistically engage modern customers and address these opportunities, so we’re excited.

How has partnering with Avanta Studios impacted your company development, milestone achievement, or fundraising?

Avanta Studios has given us incredible access to top-tier insurance feedback and distribution opportunities.

About Marble

At Marble, we want to ensure that our members are in control of one of the most important financial instruments in their lives: their insurance. We built Marble to empower our members to become informed managers of their insurance.

To learn more, click here.

About Avanta Ventures Studios

Avanta Studios offers a customized approach to helping startups reach their milestones and growth. The Avanta Studios program enables startups to partner with Avanta Ventures and CSAA Insurance Group to jointly explore new markets, business models, and technologies. By joining the Avanta Studios community, you will gain valuable insights through direct access to well-established relationships within the Insurance and Mobility ecosystems.

To learn more, click here.