Insurance-as-a-Service (IaaS) startups offer insurance and non-insurance companies modularized, or full-stack insurance solutions, as a service through flexible cloud-native infrastructures and application programming interface (API) connectivity. This creates an opportunity for non-insurance companies to launch their own insurance programs without the heavy lift of building in-house insurance management systems and underwriting capabilities.

Established insurance companies may opt for à-la-carte solutions, such as claims management-as-a-service, underwriting-as-a-service, or embedded distribution channels, as opposed to full-stack solutions preferred by non-insurance companies. Point solutions may help insurance companies solve for specific inefficiencies they have due to the lack of resources or expertise in emerging markets of interest.

Launching a new insurance program is a heavy lift

There is a lot to consider when launching a new insurance program. For starters, understanding the nuances of insurance regulations and how they vary by state is a critical first step. It’s very common for State Departments of Insurance to deny new program applications due to a lack of compliance, whether related to forms, rating algorithms, or underwriting guidelines. An insurance company looking to launch new products must also evaluate its infrastructure and assess whether its policy administrative system (PAS) and claims administrative system (CAS) can support policy distribution, service, first notice of loss (FNOL), claims adjudication, and settlement for the market it wishes to enter.

For non-insurance companies (e.g., mortgage originators, fleet operators, car dealerships, payment providers, etc.) with no existing insurance infrastructure, launching an insurance program becomes an even heavier lift. As such, partnering with cloud-native insurance companies that offer modularized and full-stack insurance solutions as a service via API connectivity may be a relatively quick and efficient solution to add to an existing workflow.

The insurance-as-a-service opportunity has attracted numerous startups. Boost Insurance has built an ecosystem of carrier partners and reinsurers that give InsurTech managing general agents (MGAs) quick access to risk capital and underwriting. Non-insurance companies, like Acorns, have leveraged Boost’s API to offer white-labeled insurance products, like pet insurance, to its existing customer base. Bindable is another example of a company offering turnkey distribution solutions to non-insurance companies looking to offer complimentary insurance products to their existing customer base.

Another consideration when launching new insurance programs is evaluating internal operational resources. Entering a new market successfully requires actuarially sound pricing models, policyholder document creation, robust underwriting guidelines, distribution capabilities, and reinsurance capacity. InsurTech startups may decide to partner with IaaS platforms, such as Slice or Boost Insurance, to streamline go-to-markets, but in doing so they give up partial or entire control of pricing, claims, and the end-to-end customer experience. While InsurTech MGAs and brokers may leverage IaaS platforms initially — to streamline insurance licensing requirements, acquire reinsurance capacity, leverage actuarially justified pricing algorithms, and plug into existing policyholder distribution networks — they are likely to roll off these platforms as they mature to capture higher business model margins. Dependence on a third-party IaaS platform may also limit a startup’s exit opportunity.

At Avanta Ventures, we see non-insurance companies as a more compelling customer opportunity for sustainable growth within the IaaS vendor landscape, relative to selling to InsurTech MGAs. Non-insurance companies represent unique channels for traditional insurance companies to distribute contextually pertinent insurance products to customers with underserved needs. Non-insurance companies collect unique data points and insights into customer behavior that can be used to tailor relevant insurance offerings. Offering embedded germane insurance products on top of primary products and services creates an opportunity to convert insurance policyholders at lower customer-acquisition costs. Embedded insurance enables non-insurance companies to create new streams of revenue, deepen their customer value proposition, decrease churn, and increase customer lifetime value. However, non-insurance companies lack the backend infrastructure and operational resources needed to build their own in-house insurance program and would benefit significantly from simple insurance API integrations to their existing workflow.

Traditional insurance stack is becoming modularized and offered as a service

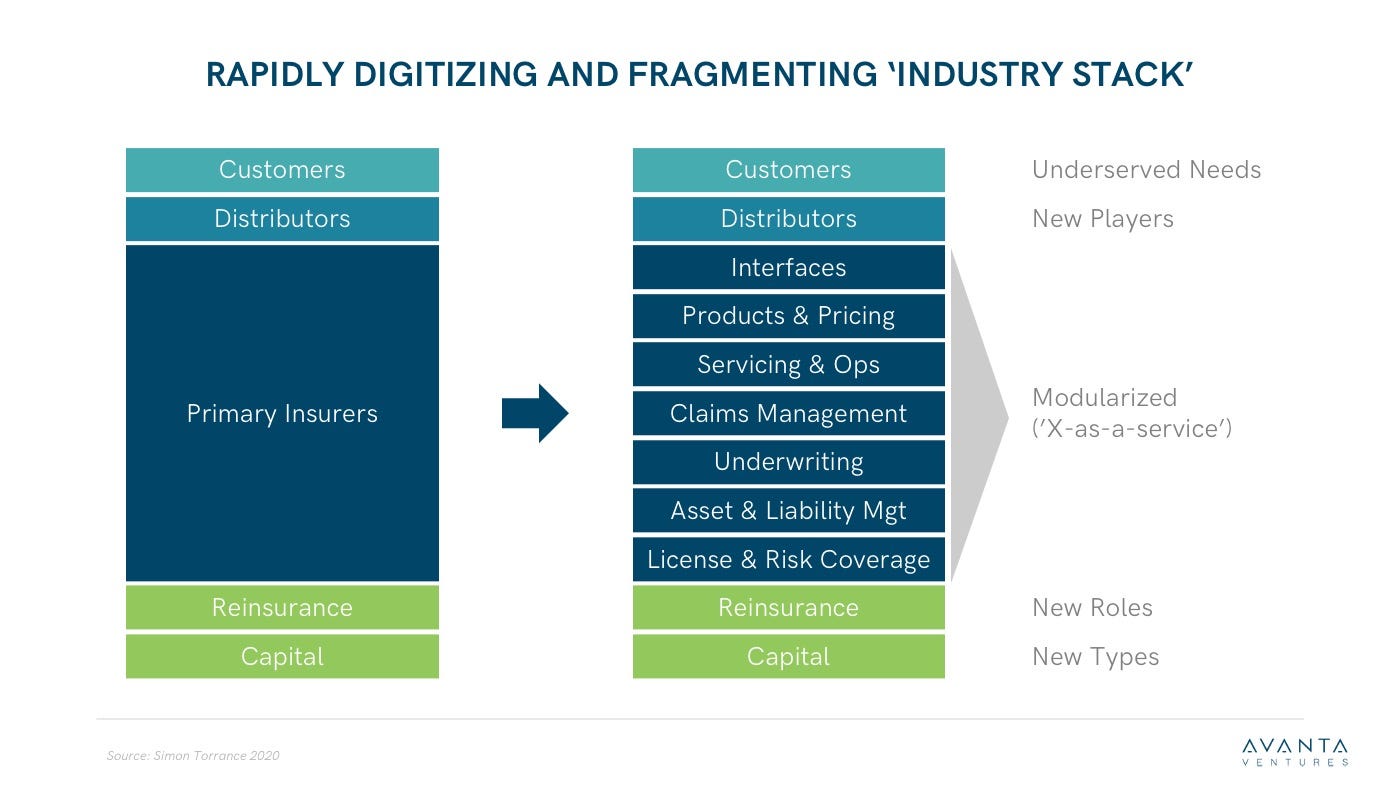

The attractiveness of the embedded insurance market has driven the fragmentation of the insurance stack in which core insurance capabilities, such as underwriting and claims management, are being modularized and offered as point services or entire suites.

While non-insurance companies may choose to piece-meal different insurance services from different IaaS companies based on specialties (e.g., underwriting versus claims management), the most successful IaaS companies will provide full-stack insurance solutions as a service to third parties looking for robust and complete end-to-end insurance programs. Non-insurance companies will want to deal with only one insurance partner when problems inevitably arise.

Startups are building flexible infrastructure to meet the dynamic needs of the sharing economy

While startups like Slice and Boost Insurance offer traditional insurance carriers and InsurTech MGAs an efficient platform to launch new digital insurance products, we’ve seen several IaaS startups focused on the sharing economy. Mobility companies such as Uber, Lyft, Turo, and Amazon DSP need flexible insurance solutions more than ever. Transportation of people and goods is dynamic and on-demand; insurance should be no different.

Companies like Trov and Lula Technologies are rebuilding the insurance infrastructure for the sharing economy of the future. Through a simple API connection, mobility companies, fleet managers, and trucking and logistic providers will be able to launch their own robust insurance programs and risk-assessment tools within their existing workflow. For example, deploying a last-mile delivery van will instantly trigger an API ping to the IaaS partner’s platform, initiating insurance coverage tailored for that specific delivery van’s risk exposure.

What does this mean for the future?

Cloud-native insurance infrastructures and API connectivity have enabled startups to modularize the insurance value chain and offer specific or entire components as a service to both insurance and non-insurance companies.

To stay competitive moving forward, insurance programs must become increasingly flexible and responsive based on how the world experiences transportation and the complementary products and services consumers purchase.